Guide to Financial Planning: RMD Trap

You have probably heard this promise before, “Shelter your money by putting it into an IRA or employer-sponsored retirement plan (401k, 403b, 457, etc.). Your money will grow tax-deferred until you retire and start to use it. But, no worries, you will be in a lower tax bracket and so you will have “cheated” Uncle Sam out of thousands of dollars of Federal taxes!”

Unfortunately, this is a common misconception and Uncle Sam saw you coming. Starting no later than April 1st in the year after you turn age 70½, owners of Traditional IRA’s and other retirement plans must start withdrawing money from their IRA or 401k. These are called Required Minimum Distributions (“RMD’s”) and you must start taking the “RMD” whether you need the income to live on or you don’t.

The only exception: if you are still working at age 70½ you must take an RMD from your IRA plan, but you don’t have to start taking RMD’s from your 401k, 403b, or 457 retirement plan(s).

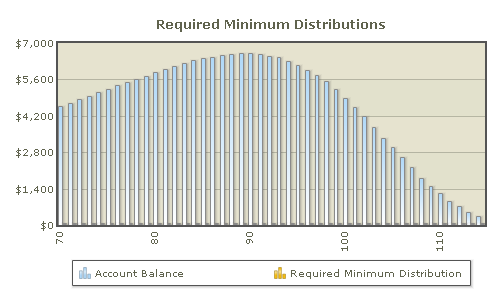

This is when you begin to get caught in the trap – quicksand, if you will. So, ok, we have to take out a minimum amount of money each year because Uncle Sam wants his tax revenue. We get it. How much do we have to take? Uncle has a formula and tells us what it is, but the amount isn’t the same year-after-year. Look at how the RMD table works out for you if you have just $125,000 in an IRA or 401k, you are 70½, and you continue to earn just 3% on your savings during your retirement:

Hold it! Why does your RMD rise until about age 89 and then decrease big-time thereafter? This is because the average lifespan of a male and female is age 89 and Uncle wants his money before you die. This is the ugly truth you didn’t know about.

The trap is simple…

Withdraw money you didn’t need to begin with, live longer due to medical advances, and run out of money in your later years when you need it the most for medical care or the rising cost of living.

Now, it’s time for Uncle Sam to collect on your RMD’s. On a $125,000 IRA, you will need to take a first-year RMD of $4,562. Let’s see how the RMD affects your tax return:

You and your spouse are 70 years old and retired. You currently have $48,000 of income from your pensions and $37,000 of income from your Social Security benefits. However, this coming year Uncle Sam will require you to take a $4,562 RMD. You are only taking the RMD because the IRS requires you to – you do not need the money to live on. Here are the results:

With The $4,562 RMD

Pension Income: $48,000

Taxable Soc. Sec. Income: $25,125

RMD Distribution: $ 0

Total Taxable Income: $73,125

Federal Tax Owed: $ 6,776

Without the $4,562 RMD

Pension Income: $ 48,000

Taxable Soc. Sec. Income: $ 29,003

IRA Distribution: $ 4,562

Total Taxable Income: $ 81,565

Federal Tax Owed: $ 8,066

Minimum Additional Tax Paid*

First Year: $ 1,290

Over Five Years: $ 6,450

Over Ten Years: $12,900

Over Fifteen Years: $19,350

* Note: the “Minimum Additional Tax Paid” is the minimum increase in tax. Since your RMD will increase each year (to a high of $6,585 in the 20th year), the actual amount of tax you will pay over time is much higher.

Do you remember the quicksand we talked about? Not only are you being taxed on your $4,562 RMD, but you probably noticed that your taxable Social Security income increased from $25,125 to $29,003. This means an additional $3,878 of taxable income on your tax return.

So, let’s sum up the damage:

(1) you were forced to take a $4,562 RMD that you didn’t need,

(2) your Social Security just got taxed more, and

(3) the actual tax cost (just first-year) was $1,290 versus $4,562 of in-your-pocket income from the RMD distribution.

Divide $1,290 by $4,562: that’s a 28.28% tax rate.

Wow. Where’s that promise of a lower tax now?

You want the truth?! You can delay, for up to 15 years, taking an RMD on up to $125,000 of your IRA, 401k, 457, or 403b savings. The irony? It’s IRS-approved. No, I’m not kidding.

Do Not Take Your Required Minimum Distribution

1-888-407-2090